Contact Us

Address:

630102, Novosibirsk region,

Novosibirsk city, Borisa

Bogatkova Street,Dom

24/1

Telephone: +7-977-1177-076 / +7-923-1858-999

Email: info@severagro.com

Website: https://www.severagro.com/

Address:

630102, Novosibirsk region,

Novosibirsk city, Borisa

Bogatkova Street,Dom

24/1

Telephone: +7-977-1177-076 / +7-923-1858-999

Email: info@severagro.com

Website: https://www.severagro.com/

01 Sunflower

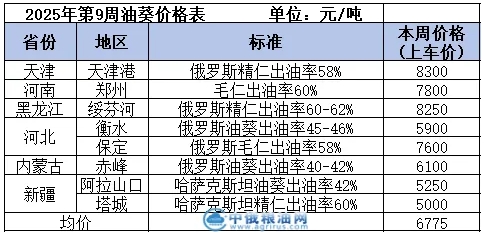

Week 9 (February 24-28, 2025) The domestic sunflower price fell this week. The specific prices in each region are as follows:

Weekly Review:

This week, domestic sunflower prices fell. The domestic sunflower market trading atmosphere is sluggish, sales are sluggish, and oil mills are in a wait-and-see attitude, replenishing stocks on demand, which is bearish for the sunflower market. At present, the sunflower market is only supported by rigid demand, so the price is weak. The supply of foreign markets continues to be turbulent, and the constant changes in exchange rates affect the import volume of sunflowers. The supply of goods in various places is tight, and the supply of sunflowers is weak, which slightly supports the sunflower market.

It is expected that the price of sunflowers may rise. Although the sales of sunflowers are slow and the demand is weak, the operating rate of oil mills has gradually recovered, and the supply of sunflowers is tight, which supports the sunflower market. Pay more attention to foreign prices and my country's import volume trends in the later period.

The business of ports and customs has recovered slowly, the supply of foreign raw materials is unstable, the exchange rate fluctuates, the supply is tight, and the arrival and pick-up time of new goods are unpredictable. In terms of price, dealers are cautious in quoting, and the fluctuation is not obvious. In the short term, if there is no policy benefit and demand recovery, the market is likely to continue to be sluggish.

02 Sunflower oil

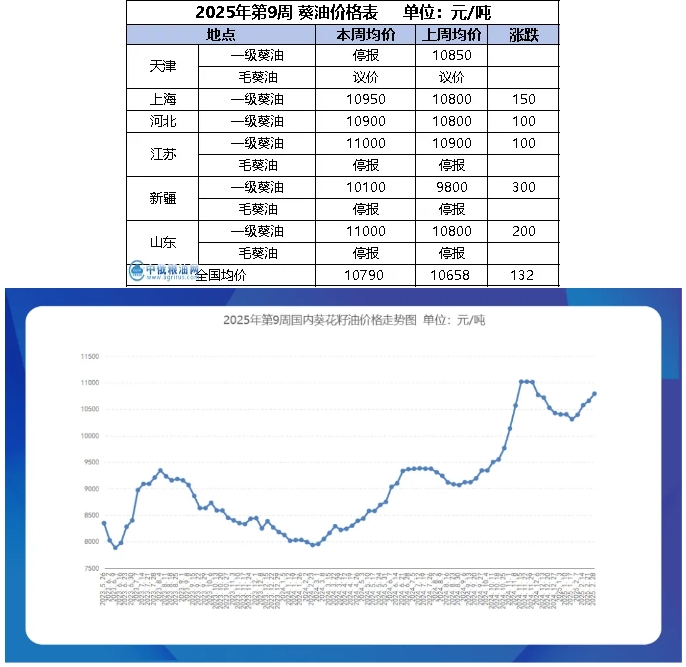

Week 9 (February 24-February 28, 2025) The average price of domestic sunflower oil this week is 10,790 yuan/ton, of which the price of first-grade sunflower oil in Jiangsu is 11,000 yuan/ton; the price of first-grade sunflower oil in Xinjiang is 10,100 yuan/ton, and the price of first-grade sunflower oil in Tianjin has stopped. The prices in various regions are as follows:

Weekly Review:

This week, domestic sunflower oil prices rose. Recently, rapeseed, soybean and palm oil fluctuated and rose, supporting the sunflower oil market. At present, the supply of domestic sunflower oil is tight, and dealers are reluctant to sell, which supports the rise in sunflower oil prices. On the demand side, due to the continuous rise in prices, some dealers began to stock up and the speed of goods was accelerated, which was good for the sunflower oil market. The tariff on Russian sunflower oil fell in March, but the ruble exchange rate strengthened, which slightly supported the Russian sunflower oil market.

It is expected that the price of sunflower oil may rise in the short term. The supply of domestic sunflower oil is tight, and the price of foreign sunflower oil is on an upward trend, so the possibility of sunflower oil rising is relatively large. In the medium and long term, Russia will lift sanctions, the arrival of Russian sunflower oil will increase, and the tight supply situation will be alleviated, which is bad for the sunflower oil market and the price of sunflower oil may fall.

|

Previous: Rapeseed, rapeseed oil and rapeseed meal trading summary and analysis forecast (week 8, 2025)

Next: Peanut and peanut oil trading summary and analysis forecast (week 9, 2025) |

Return |