Contact Us

Address:

630102, Novosibirsk region,

Novosibirsk city, Borisa

Bogatkova Street,Dom

24/1

Telephone: +7-977-1177-076 / +7-923-1858-999

Email: info@severagro.com

Website: https://www.severagro.com/

Address:

630102, Novosibirsk region,

Novosibirsk city, Borisa

Bogatkova Street,Dom

24/1

Telephone: +7-977-1177-076 / +7-923-1858-999

Email: info@severagro.com

Website: https://www.severagro.com/

01 Rapeseed

In the 46th week (November 11-November 15, 2024), the national average price of rapeseed net seeds was 2.963 yuan/jin. The rapeseed price in Jiangsu was around 3.00 yuan/jin, which was stable; the rapeseed price in Hunan was 2.90-2.95 yuan/jin, which was stable; the rapeseed price in Hubei was around 2.90 yuan/jin, which was stable; the rapeseed price in Sichuan was 3.05-3.10 yuan/jin, which was stable. The rapeseed market conditions in various regions this week are as follows:

Weekly Review:

This week, rapeseed prices in various parts of China remained stable. Rapeseed prices in Qinghai rose slightly, and trading was active. In addition, the market inventory of high-quality rapeseed was small, supporting the rapeseed market. As the aquaculture industry is in the off-season, rapeseed prices continue to be suppressed. Oil mills replenished stocks on demand, which was bearish for the rapeseed market. As of November 8 last week, the crushing volume of coastal oil mills decreased by 48,000 tons to 116,500 tons. The main reason for the decline in crushing volume was the expansion of rapeseed meal and the high inventory pressure. In terms of international rapeseed, the global rapeseed production decline has provided some support to rapeseed prices.

It is expected that domestic rapeseed will remain stable in the short term. The domestic rapeseed market has been trading steadily recently, and prices have not changed much. In the future, pay more attention to the downstream demand for domestic rapeseed, China-Canada trade relations, and the subsequent development of anti-dumping incidents.

02 Rapeseed Oil

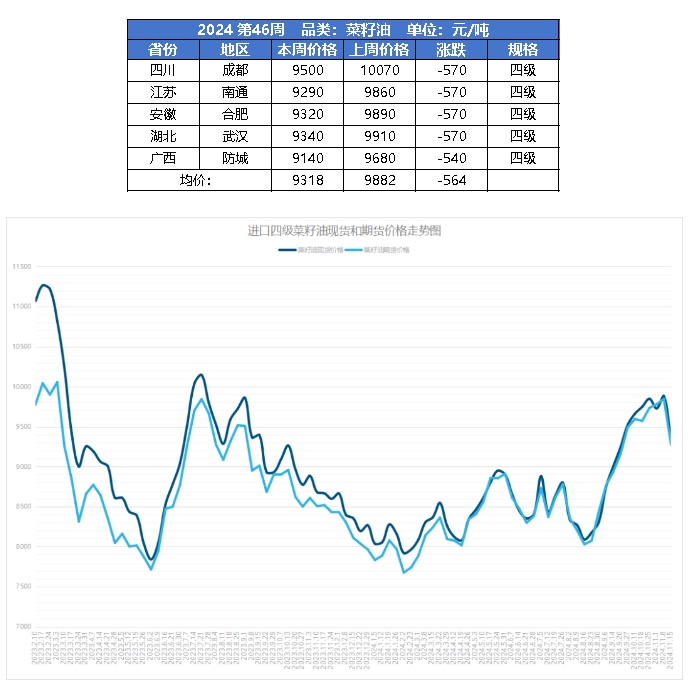

In the 46th week (November 11-November 15, 2024), the national average price of Grade 4 rapeseed oil is 9,318 yuan/ton, down 564 yuan/ton from last week. The reference prices of Grade 4 rapeseed oil in various regions are as follows:

Weekly Review:

In the futures market, rapeseed oil futures prices fell sharply this week, and the main rapeseed oil 2409 closed at 9,271 yuan/ton on Friday. The main reason is that the newly appointed head of the US Environmental Protection Agency is likely to continue to oppose the development of biodiesel. The market is worried about the demand outlook for biodiesel, which suppresses the US soybean oil market and is bearish for the rapeseed oil market. The Indonesian government reiterated to lawmakers that it will enforce the B40 plan in January 2025, supporting the palm market and thus the rapeseed oil market. The weather in South America is conducive to soybean planting, and soybean planting is progressing smoothly. The yield outlook is extremely optimistic, which is bearish for the rapeseed oil market.

In the spot market, domestic rapeseed and rapeseed oil continue to arrive in large quantities, rapeseed oil supply is abundant, and rapeseed oil stocks are at a relatively high level. The rapeseed oil market has light transactions, rapeseed oil stocks are high, and rapeseed oil fundamentals remain weak.

It is expected that the spot price of rapeseed oil futures will stop falling and rise in the short term, and rapeseed and rapeseed oil will continue to arrive at the port with sufficient supply. The reduction in palm oil production and policy relations are running strongly, supporting rapeseed oil. Overall, there are many positive factors for oil and fats, and it will take some time for the market to digest them. It is expected that the market will still be dominated by strong fluctuations.

03 Rapeseed Meal

The reference prices of rapeseed meal in various regions in Week 46 (November 11-November 15, 2024) are as follows:

Weekly Review:

Rapeseed meal prices fell this week. The main reason for the decline is that Trump's recently announced candidate for the head of the U.S. Environmental Protection Agency opposes biofuels. The market is worried that Trump's trade policy after taking office may lead to a decline in U.S. soybean exports. Under the influence of multiple negative factors, the decline in U.S. soybean futures prices led to a decline in rapeseed meal. In the spot market, the fundamentals of rapeseed meal are still in a state of strong supply and weak demand. The inventory of rapeseed meal is at a high level, and the supply of rapeseed meal is sufficient. In terms of demand, rapeseed meal transactions are sluggish, and the demand for rapeseed meal is weakened due to the off-season of aquaculture. The actual trading volume is general, and downstream purchases are cautious.

It is expected that rapeseed meal will run weakly in the short term. Rapeseed meal lacks support from positive factors, supply is strong and demand is weak, and soybean meal is more cost-effective than rapeseed meal, which suppresses the rapeseed meal market. In the later period, pay more attention to the price difference between soybean and rapeseed meal, the price difference between sunflower and rapeseed meal, the port arrival volume and the start-up situation, and continue to pay attention to the trade relations between China and Canada and China and the United States.

|

Previous: Domestic peanuts, peanut oil, and peanut meal trading summary and analysis (Week 46, 2024)

Next: Domestic flaxseed, flax oil and flax cake weekly market forecast (week 46, 2024) |

Return |